Since inflation fear peaked out in June, energy companies have given back large chunks of their post-vaccine gains. This is especially true for those further out the risk curve, with operational and financial leverage at play.

NOV is a Houston-based provider of technology and equipment to the hydrocarbon services industry and more recently, the renewable energy industry. The company effectively sells the “picks and shovels” to energy contractors and producers, and therefore has some small competitive advantages in a traditionally brutal industry, due to patented methods and technologies.

The first iteration of the company (formerly known as National Oilwell Varco, changed in Jan 2021), commenced operation in 1862 manufacturing pumps and derricks for the burgeoning oilfields. Multiple mergers and and conversions saw the final coming together of National Oilwell and Varco in 2005. NOV is a fine example of the Lindy Effect at work. There is a certain comfort in knowing that a company has survived for 159 years in one of the most crushing, cyclical industries there is.

While smaller than the drilling giants Schlumberger, Halliburton and Baker Hughes, NOV has found a niche for itself, and its size at a market cap of $4.8b and 2020 revenues of $6b provides for significant size-advantage and scale. It is currently active in 61 countries.

The energy washout

To witness the bruising dealt out on the energy industry since oil’s peak seven years ago, consider that NOV had a $35b market cap in 2014 (although their spun-off industrial supply division, DistributionNOW also needs to be added back- $780m market cap).

While the company is still inexorably tied to the amount of global drilling activity, which has been an awful headwind (see chart below), I equally believe that its strengths ensure NOV will be a strong player in the energy capex recovery. Companies are unlikely to quibble at the wellhead, where downtime means huge costs, and will continue to back the proven providers.

The business

NOV is led by CEO Clay Williams, an oil man through and through, who has been at the company since 1997 and served as CFO and COO, before taking the reigns in 2014. I am highly skeptical of energy CEOs, but Williams has done a solid job of managing the company during the length of the bear market, having taken the role the year oil peaked.

Dilution has been avoided, with the share count mostly stable over the down market. While capex has averaged a reasonable $234m annually between 2018-20, on average revenues of $5.3b.

The balance sheet has been well-managed with low debt levels and maturities consistently pushed out, well in advance. The table below from the 2020 annual report highlights how backended these loans are, with over 3/4 of debt not due until 2029 and over half until 2042 at 3.95%– an exceptional piece of management within a fragile industry, in my view.

NOV reports under three segments- Wellbore Technologies, Completion & Production Solutions and Rig Technologies. These three segments are fairly equal in their scope, with Wellbore the largest in 2019 (providing 37% of revenue), however the aformentioned well slump in 2020 saw C&P lead with 41% of revenue, followed by Rig (31%) and Wellbore (29%).

Being the most cyclically exposed of the divisions, Wellbore should naturally lead on the way back up when the time comes. Q2 showed signs of possible greenshoots with revenues of $463m, up 12% from Q1, and EBITDA of $63m at a 13.6% margin.

C&P also saw a low-teens revenue improvement in Q2, up 13%, although operating and EBITDA margins remained challenged, while Rig Technologies also gained 13% on Q1, bringing in revenues of $487m and $74m of EBITDA on a 15.4% margin. The reason for the relative resilience of these two segments throughout the worst of last year is their order backlogs, which operate on a lag. Work scheduled more than three months out is classified this way and slower to be canned in times of turmoil. For the end of Q2 C&P and Rig held backlogs of $1b and $2.7b respectively.

One potential growth path for the company is renewable energy services, particularly wind. NOV has already been successful in winning contracts in this area and although they are inconsequential to profitability at this point, it is natural that many of their systems are compatible to the energy transition.

The company announced on Aug 23 that it had secured a contract to supply two new offshore wind turbines to European shipping company Cadeler, to be delivered in 2024. A change in narrative towards NOV’s role in the energy industry’s decarbonisation could be very positive, given that it is currently very much on the ESG outer. This is unfairly so, in my view, as the company has designed technology that allows for conventional oil and gas production at much lower carbon intensity than in the past.

Accepting the reality that hydrocarbons can’t easily be removed from global energy supply, under even the most optimistic transition timeframes, it makes since to continue these practices as efficiently as possible. It is likely that the market will come to rewarding cleaner traditional energy production over time.

Additionally, NOV’s revenue is well diversified, with 73% coming from outside the US and no single customer larger than 10% of revenue.

Safety and liquidity

Similarly to my thesis on energy services peer Saipem, I am placing less emphasis on current results for NOV. Obviously we are in a deep cyclical trough for companies that rely on E&P’s capex for their revenue and there just isn’t much to analyse that is relevant to what a normalised, mid-cycle year will look like.

Having satisfied myself the company is very cheap, the main analytical question becomes whether NOV will survive to the recovery, even if it takes longer than predicted.

In this regard, NOV has an excellent balance sheet and liquidity, with net debt of only $114m (at June 30) comparing favourably against 2020 Cash Flow From Ops of $926m. In April this year, the company used cash on hand to redeem $182.7m of senior notes, not due until December 2022- a clear vote of confidence in its resilience. Additionally, NOV has access to a $2b revolver, currently undrawn.

Clearly in terms of financial strength, NOV is a standout amongst energy-leveraged equities. A long history, combined with strict cost controls and manageable debt place it more favourably than most peers. With respect to the operational and financial leverage I mentioned in opening, the company features much more of the former than the latter- arguably the safer combination.

Within the energy space, the ability for profitability to rip back with a vengeance distinguishes the group that will see the large multi-baggers as the energy recovery continues. Of course, the Chevrons and Totals will survive this rout, however long it lasts, but they are also unlikely to give quite the same level of returns due to their size and relative stability within the industry.

The outlook and valuation

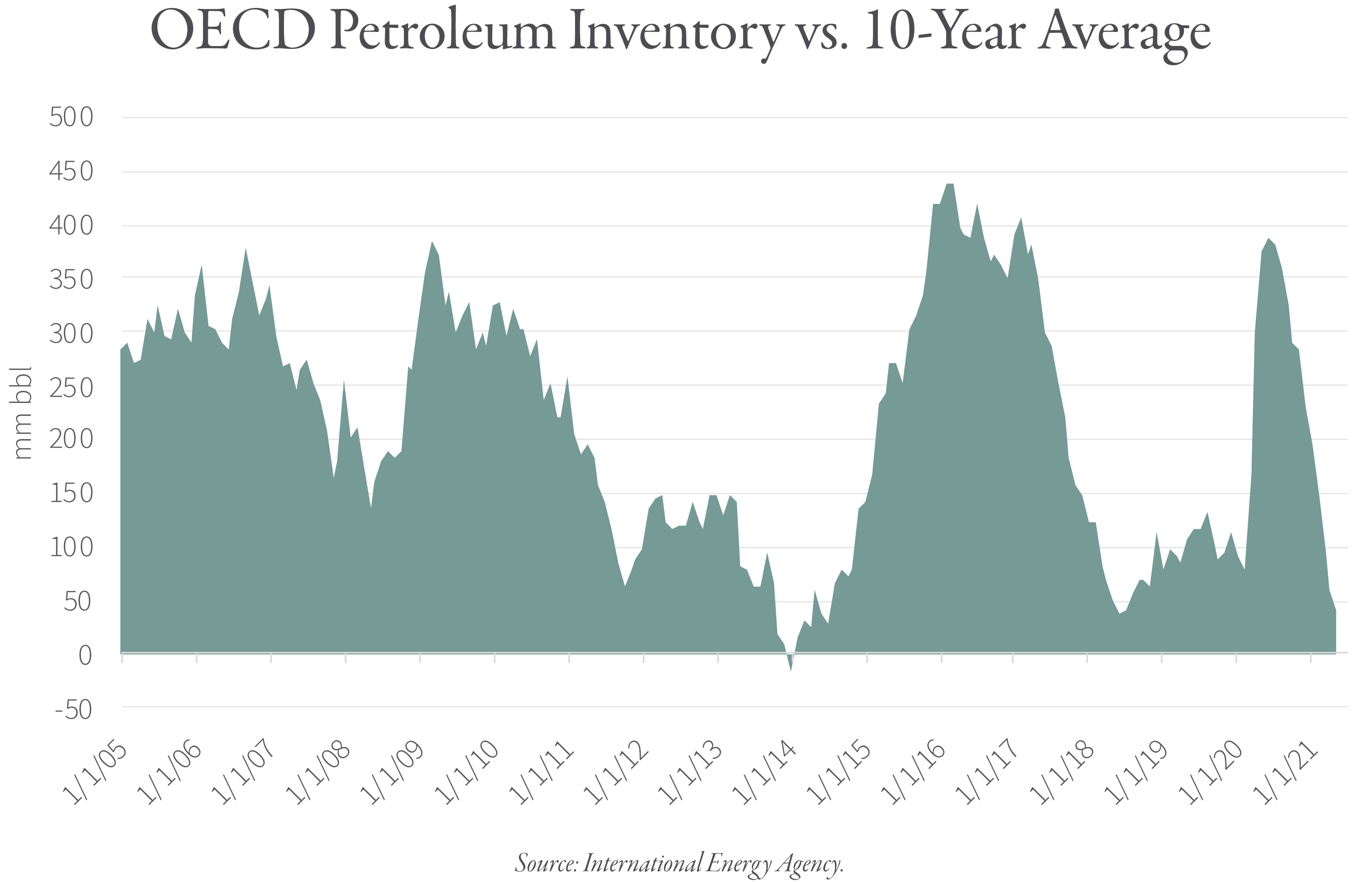

The collapse in the rig industry last year logically will have its consequences as energy demand returns in a post-pandemic world. A recent piece by industry experts Goehring & Rozencwajg highlighted the rapid drawing down of oil inventories to 15 year lows, after having spiked dramatically last year.

To avoid an energy supply disaster, there is going to need to be substantial capex flows into exploration and production very soon. Clearly, NOV stands to benefit heavily from this.

It is quite possible this spending may be more explosive than most imagine, due to the extreme cost-cutting of 2020. Many companies raided their old equipment and put off borderline-neccessary spending to tighten budgets, but this is only sustainable for so long. They will be forced to play catch up to get producing again quickly.

On a peer comparison, NOV has underperformed the Oil & Gas Equipment & Services ETF (XES) since the Jan 2020, down 48% over this period vs 45% for the index. This is despite a lighter capital intensity and the impressive balance sheet mentioned above, with net debt/equity of 2% comparing very favourably to Schlumberger’s 102% and Halliburton’s 118% (also two companies I would expect to do well from here).

To frame the business in a recovery environment, I am using a conservative method I have been applying to many energy stocks- comparing 2019 EBITDA and Revenue to the current EV and Market Cap. Given that 2019 was already deep into the energy bear market, but doesn’t include the generational wipe-out of Covid, this shows a “normalised” scenario that still allows a huge margin of safety if a company appears cheap on these metrics.

NOV looks very reasonable on these measures currently selling for 5.8x EV/’19EBITDA ($885m) and .6x P/’19S ($8.5b). While remembering that in 2014 at the top of the last cycle EBITDA was $4.4b and revenues were $21.4b, as an example of how the wheel can turn if things go well.

| Net Debt/Equity | EV/2019 EBITDA | Price/2019 Sales | |

| Halliburton | 118% | 20 | 0.8 |

| Schlumberger | 102% | 7.6 | 0.85 |

| NOV | 2% | 5.8 | 0.6 |

My fair value for NOV today is $22.30/share, based 10x 2019 EBITDA or ($8.85b EV -$114m Net Debt), implying 70% upside. I believe this will prove conservative as the energy cycle roars back into gear and the company proves to be ideally placed in the middle of the capex stampede. Given minimal financing costs, the company will be well placed to pay significant dividends to its owners.

For those that follow the blog over email (not Twitter), I have said I will aim for a post per day (minus weekends) while NZ is in Level 4 Lockdown. I hope I can keep the quality up but we’ll see how it goes. Thanks for reading!

Guy

Please don’t take this as financial advice. Do your own due diligence and consult a professional advisor, if unsure about your finances.

One thought on “NOV Inc: A Survivor With Leverage to the Energy Revival”