As many of you know, I’m constantly searching for the most beaten up valuations I can find and seeing what has been passed over by the market. Today I’m posting my thesis on Micro Focus plc, which suffers the dual ignominies of already being in a revenue down-grade cycle when Covid-19 hit and being primarily listed in the UK (not sure which is worse in the current market, but both are ugly).

Research is always best in collaboration so if you have any opinions, please let me know.

Micro Focus plc is a global provider of enterprise software to over 40,000 clients worldwide, formed in 1976 in Newbury, England. The company provides IT operations management, analytics and security solutions, through a combination of valuable legacy software and newer technologies. Familiar names under the Micro Focus banner include Novell, COBOL, Attachmate, SUSE (recently sold) and most recently Hewlett Packard Enterprises’ software business.

The company had built shareholder value satisfactorily over time through astute acquisitions, share buybacks and strong dividends, until stumbling badly with its giant acquisition of HPE Software for $8.8b in 2017. This was truly a minnow attempting to swallow a whale and the ensuing indigestion has torpedoed MFGP’s equity to depressed levels today, as promised synergies and integration have taken much longer than anticipated.

Micro Focus’s current Enterprise Value of $5.64b is proof enough of the value destroyed in this transaction, but it is through this pain that, I believe, global value investors have been presented with an extremely attractive opportunity today. The business produced a series of revenue downgrades throughout 2019 and was already on the back foot when the Covid-19 pandemic hit.

After a brutal 18-month period, which saw the stock slide from $40 to $5, the pulling of the dividend (due to prudent liquidity preservation) saw a final capitulation of many long-time MFGP shareholders. Numbers reported recently have included large headline losses, due to asset write-downs and impairments mostly linked to the HPE integration. To add insult to injury, the company’s stock has languished at its March lows as many poorer companies have ripped higher, in many cases the lower quality the better.

But all is not lost. These asset write-downs have been non-cash and reflect mistakes of the past. They are also obscuring the cash profitability of the business today. Under the hood, MFGP is not bleeding. In an environment where so many companies are haemorrhaging funds, Micro Focus generated $304m of FCF in the six months to April 30 this year. Underlying EPS (netting out non-cash impairments) came in at 72c, placing the company’s equity on a PE of 5.5x 2020 H1 lockdown affected earnings- an extraordinary number.

The UK

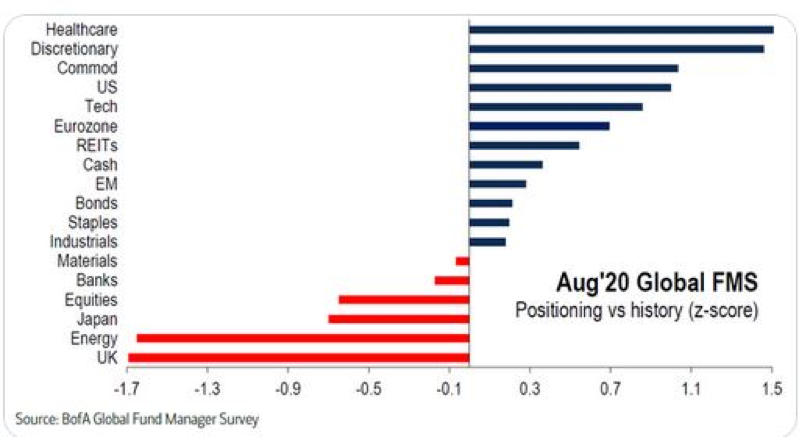

Compounding the company’s woes have been its primary listing and domicile in the UK during a time a complete revulsion towards British stocks. Bank of America’s August Fund Manager Survey showed institutions more underweight UK stocks than any other asset class, including energy- no mean feat. I am a UK bull based on the belief that Brexit will pass one way or the other, but that the absolute worst outcomes are already more than priced into the FTSE and the Pound. I appear to be very lonely in this view.

Liquidity and Debt

The obvious question to answer is, is Micro Focus a value trap? It is certainly being priced like one and it would be foolhardy to rush into a beaten-up proposition without considering the bear case. I believe the market’s main concern revolves around its debt load and whether Covid-19 will force a capital raise.

Although Micro Focus’s debt levels are a significant portion of its EV (Net Debt-$4.3b), due to its depressed market cap, its debt/equity sits at 86% and net debt/EBITDA is currently 3.4x. While the company targets a net debt/ratio of 2.7x, these are still levels more than manageable for an enterprise with the cash conversion profile of MFGP.

There is also wiggle room available through expense reductions and the withholding of the dividend. While the dividend could almost certainly have been paid, I believe it was the right move by management to husband the cash, given the extreme uncertainty we have witnessed this year. Management had originally announced a final dividend that would have taken the total payout for 2019 to $439m or $1.16 per share, however, cancelling the final saved half this amount and will continue to provide huge flexibility while it is held back. Under the assumption that dividend focused investors have now left the register, it would create much more value going forward to execute buybacks with those funds.

Management acted in May to refinance their 2021 debt maturities, by allocating a 600m Euro (EURIBOR + 4.5%) and a $650m (LIBOR + 4.25%) loan offering. These moves have extended the company’s average debt maturity to 4.2 years and, most significantly, there are now no maturities due until 2024.

As of April 30, the company had cash on hand of $808m, made up of $633m generated from operations and $175m drawn down from their revolving credit facility. Total liquidity is $1.1b when taking the full availability of the revolver into account. Given that the company reported $1.05b cash from operations in 2019 (this included four months from the SUSE business, before divestiture) and $561m in H1 2020, it is clear debt coverage is very comfortable at current levels.

Micro Focus generates 70% percent of its revenue on a recurring basis and as such, is unlikely to see significant cyclicality in revenues. In their interim earnings call in July, management estimated that first half revenues had been negatively affected 2% by Covid-19. They said there had been cases of clients delaying or watering down projects, but that largely their products are critical to their clients’ operations and expected revenue impact to remain muted and cash flows strong.

Strategy

Micro Focus has generally exhibited deft capital allocation skills throughout its corporate life. Share buybacks have been used sparingly and at the right times, dividends have been consistent and strong and compatible businesses have generally purchased at sensible prices.

As a recent example of this, the company acquired Attachmate in 2014 for $2.3b, issuing $1.2b of its own equity to do so. Valuable software was the rationale behind the deal including Novell, NetIQ and SUSE. In 2018, SUSE was sold to investment firm EQT Partners for $2.535b. The proceeds from this deal were used to pay down debt, buyback shares and return capital to shareholders through a Return of Value transaction in a tax efficient manner.

The company’s product offering is so diverse, it can operate as a one-stop-shop in IT operations for many of its clients. Revenue and customer base are globally spread and no single customer can hurt the company, which has over 40,000 clients worldwide. In 2019, 52% of revenue came from North America, 37% from the international segment and 11% Asia Pacific.

The assets that Micro Focus targets, and often its largest successes, are legacy software that are often being unloaded at bargain prices. They are the unwanted names in the portfolios of tech companies striving to show growth and innovation. MFGP’s record of buying these at low prices and extracting cash streams is enviable and the integration they achieve by spanning old and new software applications makes their client retention extremely sticky. They are managing many important balls in the air for their customers and finding a new IT management partner who can cover all this would be extremely difficult for these clients.

In February 2020, the business reported the findings of its Strategic and Operational review, which contained targets to improve operations over the next three years. These included key hires, further leaning up expenses and (most importantly in my view) accelerating the transition of as many clients as possible to SaaS and subscription models. All of which sounds positive, if not a little vague. Time will tell if management succeeds, however I don’t believe it is key to returns- today’s price gives a large enough margin of safety to the current business and any future growth will be a bonus.

February also saw the departure of long-time influential chairman, Kevin Loosemore, who was perceived as the architect of the firm’s previous rise. He has been replaced by Greg Lock, who promptly stepped up to buy shares in the open market, acquiring a stake worth $1.8m.

The HPE Disaster

Micro Focus’s current spell in the doghouse stems from its empire-building acquisition of HPE Software in 2017. In the board’s own words, it sought to-

• create significantly greater scale and breadth of product portfolio covering largely adjacent areas of the software infrastructure market, thereby creating one of the world’s largest pure- play infrastructure software companies;

• add a substantial recurring revenue base to Micro Focus’ existing product portfolio, together with accessing important new growth drivers and new revenue models; and

• accelerate operational effectiveness over the medium term, through the alignment of best practices between Micro Focus and HPE Software in areas such as product development, support, product management, account management, and sales force productivity, as well as achieving operational efficiencies where appropriate.

Source- Micro Focus circular RE the merger (9/5/2017).

HPE Software had achieved $3.2b in revenue, $660m in EBITDA and a $140m profit in 2016, giving single year multiples of 2.75xRevenue, 13.3x EBITDA and 63x Earnings at the deal price of $8.8b. These are certainly comparable to many deals done in the IT space, but there was clearly not a margin of safety in the need for HPE to start pulling its weight mightily to justify its earnings contribution going forward.

The deal involved debt financing of $5.5b, pushing the company out past its leverage targets (to 3.3x Net Debt/EBITDA), however this was expected to be brought back down within two years of settlement. Chris Hsu took over the role of CEO at the merged entity, from his previous role as manager at HPE. However, he only lasted six months before resigning when the enormity of merging the two entities together had already started affecting financial results heavily.

Stephen Murdoch returned as CEO, but revenue continued to fall throughout 2018-19. The market rapidly removed the growth multiple from Micro Focus stock with a series of gut- wrenching drops on trading updates. Despite this though, Micro Focus was still achieving positive cash flows further down the financial statements and managed share buybacks throughout this time.

It is possible that Micro Focus will have continued struggles integrating HPE Software and Covid-19 has introduced further uncertainty. However, the merged entity is now achieving solid results and, with the current washed out price, today’s shareholders can step in where others have already paid for past sins.

Valuation

Whereas Micro Focus once had a stated aim of “achieving 15-20% annual shareholder returns”, before its fall from grace, I believe the company is now priced to do just that.

I judge conservative normalised free cash flow at $450-500m, which puts the equity on a normalised FCF of 34%, when the dust settles from Covid-19 and the continued stabilisation of the HPE merger is completed. This shouldn’t be hard to imagine, given the business achieved $304m in FCF for the pandemic effected H1 2020.

In deciding a fair value for the stock, I have refrained from assuming growth in the business. While it would be a bonus, and justify a multi-bagger return to the equity, I think Micro Focus stabilising at its current profitability and using the levers at its disposal to drive shareholder will be enough to give a significant return and margin of safety.

Put simply, Micro Focus is one of the cheapest cash generators currently available in global markets, in my opinion. For a company with these levels of recurring revenue and cash flows to trade at today’s multiples is, frankly, untenable and represents a bargain opportunity.

This is further illustrated by a study of public comparables within the software management space, including Aspen Technology (30x EV/EBITDA, 40x FCF) and PTC (38x EV/EBITDA, 44x FCF). Both are viewed as growthier by the market, but the valuation contrast is stark.

I believe safe fair value today lies at 12x normalised FCF or a market cap of $5.4b (or $16/12GBP per share)- 4x today’s price. This is my base case predicated on the business failing to buy back shares, pay down debt and grow acquisitively going forward. To my mind, this is unlikely as Micro Focus has a history of doing all these things and took advantage of Covid-19 uncertainty to acquire Altar Labs in July.

My bullish fair value is $33 (25GBP) per share, based on the company achieving $400m in 2020 FCF, then $500m in annual FCF from 2021 onwards. I have modelled the company using $300m to buy back shares (at prices of up to $8 a share) and $100m ($200m from 2021) to pay down debt. If this could be maintained for four years, 2024 financials would show Net Debt of $3.6b, with the $700m in retired debt adding approximately $25m to annual FCF after tax.

The combined $1.2b of buybacks, at prices up to twice current levels, would retire 150m shares, leaving 188m on the register as the divisor to $525m in FCF for 2024 FCF per share of $2.79 (12x$2.79=$33.48 per share).

Conclusion

Over the last two years, Micro Focus has taken a series of knocks almost singularly related to their awful acquisition of HPE Software in 2017. The associated write-downs and revenue hit, along with cancelling the dividend due to Covid-19, has obscured the underlying profitability and solid capital allocation happening at the company.

However, it is because of this confusion that an extraordinary opportunity is available to value investors willing to lean into the winds of poor headlines and the UK stock market- currently considered a basket case.

Guy

I bought shares in MFGP in November for $14 and again in March at $5. It is currently a 5% position.

PS. As always, do your own research with a any investment you consider and consult a professional advisor if you are unsure. I’m not an advisor and am just sharing the rationale behind decisions I have made.

4 thoughts on “Micro Focus: The world’s only tech stock at March lows”