In my last post (https://superfluousvalueblog.wordpress.com/2020/04/21/the-forgotten-ratio-sticking-with-cape/), I discussed how the S&P 500 is still far from cheap today. I believe this so strongly that only 9% of my portfolio is currently invested in the US, despite it accounting for around 54% of global market cap.

If this is the case, where do I believe the opportunities are in equities today?

Well for a start, we don’t even have to leave America. The very pain that has made the last several years so excruciating for deep value investing have also made the opportunity set extremely appealing looking forward. The valuation spread between US growth and US value is the second widest on record.

It is possible that this gap continues to widen, but do you really want to back a strategy that requires something in its 97th percentile to move to its most extreme level in history? I shouldn’t pose this too rhetorically, because this is what the majority of market participants are currently doing. Many subconsciously, chasing growth through ETFs or closet-indexing funds.

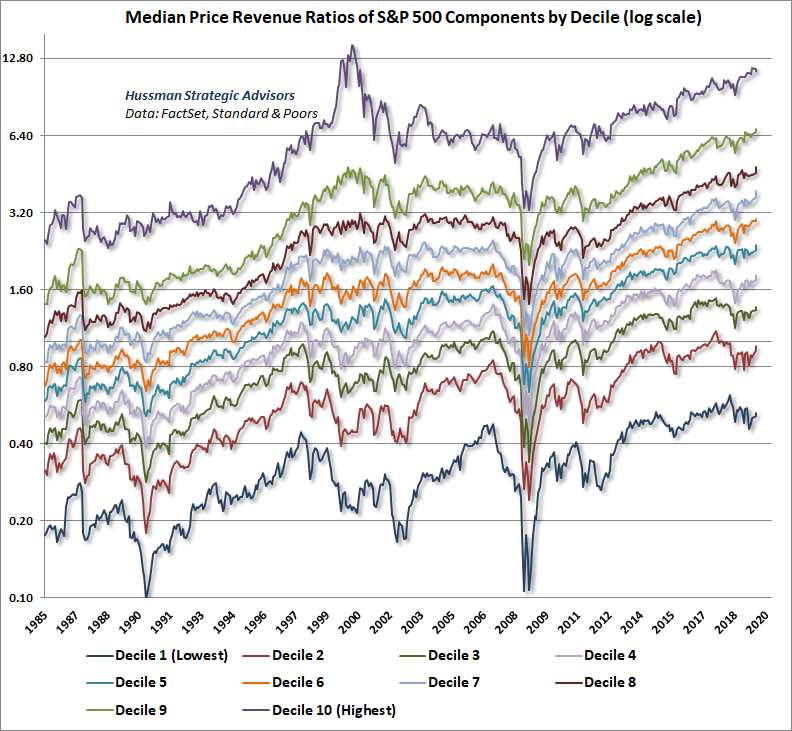

My issue with this finding is that while it proves value cheap on a relative basis, it speaks little to its valuation on an absolute basis. Luckily, Hussman Funds have done typically meticulous research breaking up the US market into value deciles (see below), which clearly shows the most expensive (growth) decile extremely rich to its own history. Unfortunately, the cheapest (value) deciles are also quite expensive relative to their long term means.

This is not yet a situation like 1999, where value stocks were cheap on an absolute and relative basis, and would actually go on to rise as the broader market lost over half its value.

There is opportunity at the individual stock level, but with the overall index at nosebleed levels, I am not convinced US value will be a safe haven in the next bear market.

Developed markets are currently looking much more prospective. For example, using Star Capital’s excellent data (https://www.starcapital.de/en/research/stock-market-valuation/, which has been updated to the 31/3), we observe developed European markets at a CAPE ratio of of 14.9x, significantly cheaper than the US.

The developed market I personally find most interesting is the UK which has been mercilessly beaten down to a CAPE of 12.1x after lurching from one political misstep to another, largely off the back of Brexit. Some have even described the UK as “uninvestable” (that wonderful word). Will the UK still be a basket case a decade from now? If not, there will have been some incredible bargains lying in plain sight.

There have been a lot of arguments made, over the last decade, as to why the US market deserves such an enormous value premium. None of them are particularly convincing unless you assume a permanently high plateau and FANGAM becoming the global economy over time.

It has been suggested that the US is simply more entrepreneurial and deserves a premium for its innovative excellence. While it undoubtedly has a vibrant capital culture and this has been a huge driver in a small colony growing into the world’s superpower over the last several centuries, the US never sustainably commanded a valuation premium until this current bull market began in 2009.

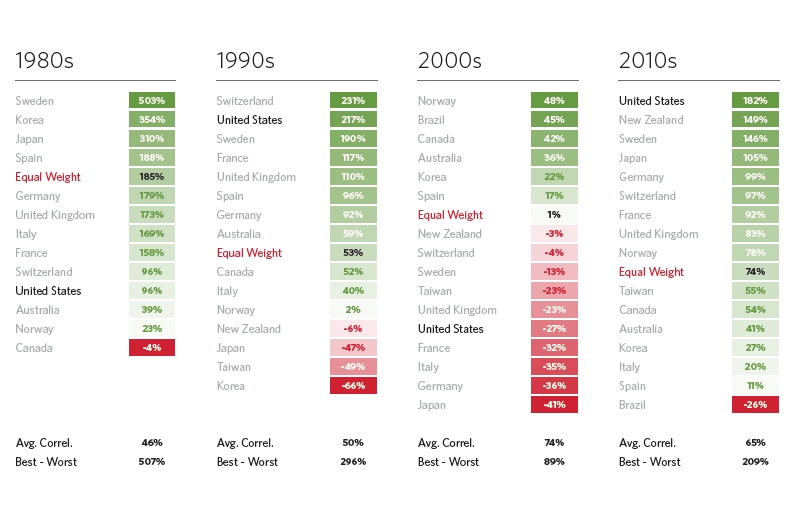

This chart from Bridgewater Associates is a stark reminder of the dangers of extrapolating past results. We can clearly see the US market drastically underperforming a global equal weight in two of the last four decades. The full data set shows the current decade as one of only four, going back to 1900, in which US equities outperformed.

Put another way, all of the US market’s outperformance over the last century has occurred during the last decade. Will this continue indefinitely? History says the chances are extremely unlikely. Could it continue for a while? Yes, of course, and that would excruciating for global deep value portfolios, but this would only stretch the rubber band to even greater extremes.

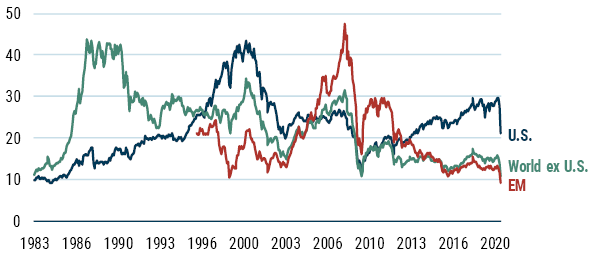

So, developed non-US markets are looking much more reasonably valued and there are certainly individual companies trading at bargain prices. However, there is one more asset class that is looking even more appealing for those ignorant of career risk- Emerging Markets.

After peaking at over 30x before the GFC, EM now trades at an all time low CAPE of 12.5x (the data only goes back to the mid-90s, but you get the point). If there is one thing I am sure of, it’s that the market will one day again be euphoric about the “middle-class miracle” of the developing nations and for this reason, along with current valuations, I am happy to hold a large number of emerging stocks in my portfolio.

As of 3/19/20 | Source: GMO

Investing through the rear-view mirror, this seems like a terrible decision, but you don’t get to rock bottom valuations when everyone loves an asset class. EMs have underperformed during this Covid-19 market thus far and they were already drastically cheap in February. My favourite markets within EM (at least where I’ve spent the most time recently) are Russia on 6x and Korea on 10x, where businesses are selling for a fraction of those in similar industries in the US. There should certainly be a premium for US equities over Russian, but 4x is breaking the record in dispersion.

Within EM there is even one last tweak that gets us to almost salivating valuations. The EM value-specific universe has traded down to a CAPE of 7x. In my previous piece I mentioned the starting point from which US stocks went on to 15-bag between 1982-2000- it was 7x. I’m certainly not forecasting the numbers, but you can still have a hell of a result even if it falls short of 15x your investment.

An overly simple outlook is that EM value will underperform until it doesn’t and then likely ten years from now it will have been the world’s best performing asset class by a country mile.

Guy

3 thoughts on “Fertile Hunting Grounds”